Kumiko Love Instagram – Tracking your spending is only the first step. The most crucial step is understanding what that spending is telling you.

Do you notice spending patterns? Is your spending aligning with your goals and values? Do you have one specific problem area you need to address and figure out?

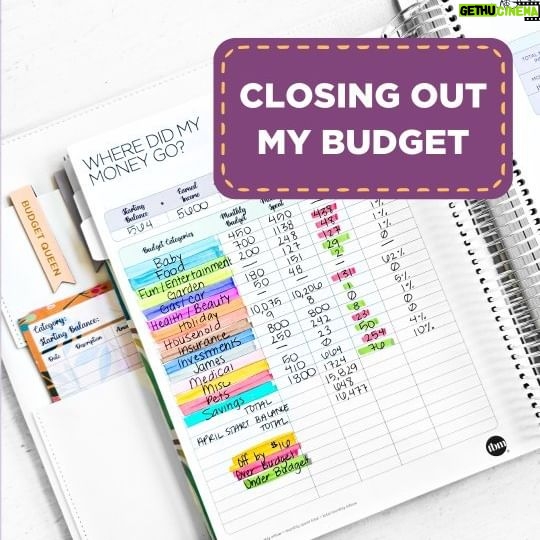

Here are the three worksheets that help me find that information:

1️⃣ The budget category breakdown. Where did my money go in specific categories, and was I over or under budget?

2️⃣ The monthly debt and savings breakdown. Since I am debt-free, I track my investments instead. More often than not, you are working on multiple goals. I like to make sure my money goes towards goals in order of priority and importance.

3️⃣ The monthly spending comparison. I always set small goals for myself month-to-month. When I can compare spending, this helps me notice trends and makes sure I am meeting those short-term goals.

Don’t just track your spending. LEARN from it!

Give me a ❤️ in the comments if you track your spending and then never look at it again? Be honest!

#thebudgetmom #budgettips #budgeting #trackyourspending | Posted on 02/Apr/2024 01:45:18