Most liked photo of Anushka Rathod with over 517.5K likes is the following photo

We have around 101 most liked photos of Anushka Rathod with the thumbnails listed below. Click on any of them to view the full image along with its caption, like count, and a button to download the photo.

![Anushka Rathod - 517.5K Likes - This is Day 9 of 10 Smart tips for your Mehnat ki Kamai!

For more details, continue reading

A. IDFC First Bank HPCL Power

a.Joining fees - ₹ 499 GST.

b.You get ₹ 500 cashback on 1st HPCL fuel transaction of ₹500 or above - [Validity: 31st March 2025]

c.Reward Points - 30 Reward Points on every 150 spent on HPCL fuel station and groceries (Note: You can earn maximum 2400 RP on fuel per statement cycle and 400 RP on grocery)

d.Reward redemption - 1 RP = ₹ 0.25, gets credited in card statement.

e.Other benefits - Domestic lounge access, discount on movie ticket and complimentary roadside assistance (conditions applied).

f.No fuel surcharge waiver

B. BPCL SBI Octane Credit Card

a.Joining fee, one time: Rs. 1499 GST

b.You get 6000 bonus reward points equivalent to INR 1500 on payment of annual fees.

c.Reward points - 25 RP on every 100 spent on BPCL fuel stations and 10 RP on every 100 spent on dining, grocery & movies (capped at 7500 Reward Points per month

d.Reward Redemption - 4 Reward Point = 1 Rs, instant redemption at select BPCL petrol pumps.

e.No fuel surcharge for transaction of up to 4000.

C. HDFC Indian Oil Credit Card

a.Joining fees - 500 taxes

b.Reward point - 5% of the amount as fuel points at Indian Oil outlets, Groceries and Bill Payments (with Capping)

c.Reward redemption - For cashback - 1 Fuel Point = ₹ 0.20, at Indian Oil with the complimentary Indian Oil XTRAREWARDSTM Program (IXRP) membership => 1 Fuel Point = 0.96

d.1 % Fuel surcharge waiver

e. Spend ₹50,000 and above in the first year and get a waiver on the renewal membership fee

Note: Terms and conditions apply for every card, fuel surcharge, eligible transaction, reward redemption etc. so decide accordingly.

[Anushka Rathod, finance, petrol, credit card, car]

#anushkarathod #finance #petrol #creditcard #car](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-11-dE4cRS8377.jpg)

517.5K Likes – Anushka Rathod Instagram

Caption : This is Day 9 of 10 Smart tips for your Mehnat ki Kamai! For more details, continue reading A. IDFC First Bank HPCL Power a.Joining fees – ₹ 499 GST. b.You get ₹ 500 cashback on 1st HPCL fuel transaction of ₹500 or above – [Validity: 31st March 2025] c.Reward Points – 30 Reward Points on every 150 spent on HPCL fuel station and groceries (Note: You can earn maximum 2400 RP on fuel per statement cycle and 400 RP on grocery) d.Reward redemption – 1 RP = ₹ 0.25, gets credited in card statement. e.Other benefits – Domestic lounge access, discount on movie ticket and complimentary roadside assistance (conditions applied). f.No fuel surcharge waiver B. BPCL SBI Octane Credit Card a.Joining fee, one time: Rs. 1499 GST b.You get 6000 bonus reward points equivalent to INR 1500 on payment of annual fees. c.Reward points – 25 RP on every 100 spent on BPCL fuel stations and 10 RP on every 100 spent on dining, grocery & movies (capped at 7500 Reward Points per month d.Reward Redemption – 4 Reward Point = 1 Rs, instant redemption at select BPCL petrol pumps. e.No fuel surcharge for transaction of up to 4000. C. HDFC Indian Oil Credit Card a.Joining fees – 500 taxes b.Reward point – 5% of the amount as fuel points at Indian Oil outlets, Groceries and Bill Payments (with Capping) c.Reward redemption – For cashback – 1 Fuel Point = ₹ 0.20, at Indian Oil with the complimentary Indian Oil XTRAREWARDSTM Program (IXRP) membership => 1 Fuel Point = 0.96 d.1 % Fuel surcharge waiver e. Spend ₹50,000 and above in the first year and get a waiver on the renewal membership fee Note: Terms and conditions apply for every card, fuel surcharge, eligible transaction, reward redemption etc. so decide accordingly. [Anushka Rathod, finance, petrol, credit card, car] #anushkarathod #finance #petrol #creditcard #carLikes : 517527

![Anushka Rathod - 395.7K Likes - Continue in comments

And share this reel with your marwari friends.

[Anushka rathod, finance, marwaris, business, lifestyle]

#anushkarathod #finance #marwaris #business #lifestyle.](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-1-YpyMNx7042.jpg)

395.7K Likes – Anushka Rathod Instagram

Caption : Continue in comments And share this reel with your marwari friends. [Anushka rathod, finance, marwaris, business, lifestyle] #anushkarathod #finance #marwaris #business #lifestyle.Likes : 395720

![Anushka Rathod - 147.3K Likes - Your Score Matters!!

Check out the whole reel to know why!!

For more details continue reading,

In our example, we have taken HDFC September rate slabs available on their website. Where if we see they offer home loan in the range of 8.75% to 9.65%

So, for example, if you take a 1 Cr home loan @8.75% for 20 years, your total interest outgo will be ₹ 1,12,09,057 /-

But if you have a low credit score banks will charge you higher interest rates.

In the above case if the interest rate is 9.65% your higher interest outgo will be ₹ 1,26,06,756 /-

Even a 7–8-month credit history can help you improve your credit score, so do take advantage of it!

Do Note: Home loan interest rate depends not only on your credit score but also on factors like your repo rate, salary, income stability, relationship with the bank, the loan amount, and your employment history.

Don’t forget to follow for part 2!!

Source:

1. HDFC Interest Rate - HDFC Bank website

2. Grow Home Loan Calculator

[Anushka Rathod, finance, home, bank, celebrities]

#anushkarathod #finance #home #bank #celebrities](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-4-lOI9uz262.jpg)

147.3K Likes – Anushka Rathod Instagram

Caption : Your Score Matters!! Check out the whole reel to know why!! For more details continue reading, In our example, we have taken HDFC September rate slabs available on their website. Where if we see they offer home loan in the range of 8.75% to 9.65% So, for example, if you take a 1 Cr home loan @8.75% for 20 years, your total interest outgo will be ₹ 1,12,09,057 /- But if you have a low credit score banks will charge you higher interest rates. In the above case if the interest rate is 9.65% your higher interest outgo will be ₹ 1,26,06,756 /- Even a 7–8-month credit history can help you improve your credit score, so do take advantage of it! Do Note: Home loan interest rate depends not only on your credit score but also on factors like your repo rate, salary, income stability, relationship with the bank, the loan amount, and your employment history. Don’t forget to follow for part 2!! Source: 1. HDFC Interest Rate – HDFC Bank website 2. Grow Home Loan Calculator [Anushka Rathod, finance, home, bank, celebrities] #anushkarathod #finance #home #bank #celebritiesLikes : 147281

![Anushka Rathod - 145.2K Likes - No Seriously, Stop doing this!!

There is an option to it so use that!

How to download it, continue reading.

1. Visit the UIDAI Website.

2. Navigate to “Download Aadhaar” from the myAadhaar page.

3. Enter Aadhaar Number and Captcha.

4. Receive and enter the one-time password (OTP) sent to your linked mobile number.

5. Check “Do you want a masked Aadhaar?” and click “Verify & Download.”

6. Retrieve the downloaded masked Aadhaar from your computer’s downloads section.

7. Open the document using a password (first 4 letters of name birth year) .

Please Note - Masked Aadhaar cannot be used for government schemes or subsidies, for such purposes, your regular Aadhaar card is required.

[anushka rathod, finance, scams, aadhaar, GOI, news]

#anushkarathod #finance #scams #aadhaar #news #GOI](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-9-1GKz4D5115.jpg)

145.2K Likes – Anushka Rathod Instagram

Caption : No Seriously, Stop doing this!! There is an option to it so use that! How to download it, continue reading. 1. Visit the UIDAI Website. 2. Navigate to “Download Aadhaar” from the myAadhaar page. 3. Enter Aadhaar Number and Captcha. 4. Receive and enter the one-time password (OTP) sent to your linked mobile number. 5. Check “Do you want a masked Aadhaar?” and click “Verify & Download.” 6. Retrieve the downloaded masked Aadhaar from your computer’s downloads section. 7. Open the document using a password (first 4 letters of name birth year) . Please Note – Masked Aadhaar cannot be used for government schemes or subsidies, for such purposes, your regular Aadhaar card is required. [anushka rathod, finance, scams, aadhaar, GOI, news] #anushkarathod #finance #scams #aadhaar #news #GOILikes : 145172

![Anushka Rathod - 144.5K Likes - This is Day 4 of 10 Smart Tips for your Mehnat ki Kamai,

Follow along as next reel will be on Investments you must avoid!

Check out the whole reel to know!!

1.Arbitrage Funds -

a.These funds make profits from price differences in the market. They buy stocks at a lower price in one place and sell them at a higher price elsewhere or take advantage of gaps between current and future prices.

b.They are subject to equity taxation.

2.Liquid Funds -

a.These funds invest only into highly rated liquid investments with minimal risk of default such as Treasury Bills (T-bills), Commercial Paper (CP) that have residual maturities of up to 91 days to generate optimal returns while maintaining safety and high liquidity.

b.They are taxed as per your income slab.

Disclaimer: Mutual fund investments are subject to market risks, Read all the related documents carefully.

[Anushka Rathod, finance, investment, mutual funds]

#anushkarathod #finance #investment #mutualfunds](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-27-UKnqh45001.jpg)

144.5K Likes – Anushka Rathod Instagram

Caption : This is Day 4 of 10 Smart Tips for your Mehnat ki Kamai, Follow along as next reel will be on Investments you must avoid! Check out the whole reel to know!! 1.Arbitrage Funds – a.These funds make profits from price differences in the market. They buy stocks at a lower price in one place and sell them at a higher price elsewhere or take advantage of gaps between current and future prices. b.They are subject to equity taxation. 2.Liquid Funds – a.These funds invest only into highly rated liquid investments with minimal risk of default such as Treasury Bills (T-bills), Commercial Paper (CP) that have residual maturities of up to 91 days to generate optimal returns while maintaining safety and high liquidity. b.They are taxed as per your income slab. Disclaimer: Mutual fund investments are subject to market risks, Read all the related documents carefully. [Anushka Rathod, finance, investment, mutual funds] #anushkarathod #finance #investment #mutualfundsLikes : 144520

![Anushka Rathod - 144.3K Likes - Follow @anushkarathod98, how much money you need to retire today coming soon!

Want to become crorepati when you retire?

Then check out the whole reel.

So, the point here is the earlier you start investing, the more you enjoy the benefit of compounding as you stay invested longer.

Remember we have assumed expected rate of return 12% p.a. actual returns may vary as per the market conditions.

[anushka rathod, finance, investing, retirement, financial planning]

#anushkarathod #finance #investing #retirement](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-4-pZMwLE6074.jpg)

144.3K Likes – Anushka Rathod Instagram

Caption : Follow @anushkarathod98, how much money you need to retire today coming soon! Want to become crorepati when you retire? Then check out the whole reel. So, the point here is the earlier you start investing, the more you enjoy the benefit of compounding as you stay invested longer. Remember we have assumed expected rate of return 12% p.a. actual returns may vary as per the market conditions. [anushka rathod, finance, investing, retirement, financial planning] #anushkarathod #finance #investing #retirementLikes : 144316

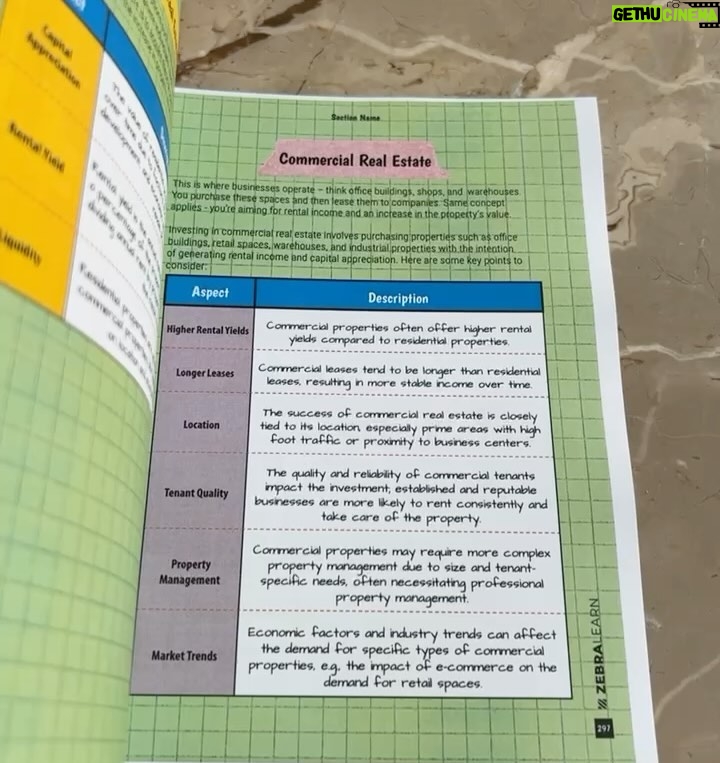

![Anushka Rathod - 139.8K Likes - You can change the game!

Presenting - The Money Guide

The most actionable and interactive book on personal finance!

In this book I’ve covered everything -

→ Developing the right money mindset with budgeting techniques & tools.

→ Complex topics like insurance and taxes.

→ Financial aspects of buying a house, studying abroad, getting a car and selecting a credit card.

→ Lastly, we’ll cover how to invest your money and build a portfolio.

And with all this you’ll find editable tools, excel and worksheets etc

So, get your copy today!

The link is in my BIO or just Comment ‘The money guide’ and I’ll DM you the link

[Anushka Rathod, finance, book, investment, home, insurance, taxes]

#anushkarathod #finance #book #investment #home #insurance #taxes](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-8-XTnQpQ9166.jpg)

139.8K Likes – Anushka Rathod Instagram

Caption : You can change the game! Presenting – The Money Guide The most actionable and interactive book on personal finance! In this book I’ve covered everything – → Developing the right money mindset with budgeting techniques & tools. → Complex topics like insurance and taxes. → Financial aspects of buying a house, studying abroad, getting a car and selecting a credit card. → Lastly, we’ll cover how to invest your money and build a portfolio. And with all this you’ll find editable tools, excel and worksheets etc So, get your copy today! The link is in my BIO or just Comment ‘The money guide’ and I’ll DM you the link [Anushka Rathod, finance, book, investment, home, insurance, taxes] #anushkarathod #finance #book #investment #home #insurance #taxesLikes : 139805

![Anushka Rathod - 127.3K Likes - Did you hear the HUGE news?!

Check the whole reel to know!!

And Small Rectification: I mistakenly said January 24. The date is actually 25th January.

Here are the conditions to keep in mind-

1. For planned procedures, simply inform your insurance company at least 48 hours in advance.

2. In emergencies, ensure you notify your insurer within 48 hours of admission.

3. Naturally, the claim must adhere to your policy terms, and the hospital must comply with the insurer’s guidelines for cashless facilities.

So, do you think will this be the next big step in transforming healthcare?

Let me know in the comments.

[anushka rathod, finance, insurance, healthcare, news, hospitals]

#anushkarathod #finance #insurance #healthcare #news #hospital](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-10-AktWUd6738.jpg)

127.3K Likes – Anushka Rathod Instagram

Caption : Did you hear the HUGE news?! Check the whole reel to know!! And Small Rectification: I mistakenly said January 24. The date is actually 25th January. Here are the conditions to keep in mind- 1. For planned procedures, simply inform your insurance company at least 48 hours in advance. 2. In emergencies, ensure you notify your insurer within 48 hours of admission. 3. Naturally, the claim must adhere to your policy terms, and the hospital must comply with the insurer’s guidelines for cashless facilities. So, do you think will this be the next big step in transforming healthcare? Let me know in the comments. [anushka rathod, finance, insurance, healthcare, news, hospitals] #anushkarathod #finance #insurance #healthcare #news #hospitalLikes : 127301

![Anushka Rathod - 112.1K Likes - THE VIDEO WAS MADE IN MARCH 2024 AND AFTER THE UNION BUDGET 2024, THE RULES HAVE CHANGED.

According to the amendments:

-> The limit on the exemption of Long-Term Capital Gains on the transfer of equity shares or equity-oriented units or units of Business Trust has increased from Rs.1 Lakh to Rs.1.25 lakh per year.

-> The rate at which Long Term Capital Gains is taxed has increased from 10% to 12.5%.

There’s a smart strategy called tax harvesting that can help you save taxes!

It involves strategically selling a portion of your investment to secure long-term capital gains and then reinvesting the proceeds back into the same securities.

This allows you to offset gains against losses or take advantage of exemption limits, ultimately reducing your tax burden and boosting your post-tax returns.

Here’s how it works: Imagine you invest ₹ lakh and see a gain of Rs. 1 lakh.

By selling before the gains reach ₹1 lakh (say at ₹ 3,98,000) and then repurchasing the investment, you can:

• Avoid the 10% Long-Term Capital Gain Tax on the initial long-term gains over ₹1 Lakh.

• Establish a new, higher-cost base (₹ 3,98,000) for future calculations, reducing your taxable gains down the line.

And as your investments appreciate again by ₹ 1 lakh, you can repeat this process to further maximize your post-tax returns.

For those investing through SIPs, remember to sell units purchased at least a year ago to qualify for tax-harvesting benefits.

Disclaimer: This information is intended for educational purposes only and should not be considered a substitute for professional financial advice.

[anushkarathod, tax, finance, taxharvesting]

#finance #tax #LTCG #taxharvesting](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-4-jcih0O8402.jpg)

112.1K Likes – Anushka Rathod Instagram

Caption : THE VIDEO WAS MADE IN MARCH 2024 AND AFTER THE UNION BUDGET 2024, THE RULES HAVE CHANGED. According to the amendments: -> The limit on the exemption of Long-Term Capital Gains on the transfer of equity shares or equity-oriented units or units of Business Trust has increased from Rs.1 Lakh to Rs.1.25 lakh per year. -> The rate at which Long Term Capital Gains is taxed has increased from 10% to 12.5%. There’s a smart strategy called tax harvesting that can help you save taxes! It involves strategically selling a portion of your investment to secure long-term capital gains and then reinvesting the proceeds back into the same securities. This allows you to offset gains against losses or take advantage of exemption limits, ultimately reducing your tax burden and boosting your post-tax returns. Here’s how it works: Imagine you invest ₹ lakh and see a gain of Rs. 1 lakh. By selling before the gains reach ₹1 lakh (say at ₹ 3,98,000) and then repurchasing the investment, you can: • Avoid the 10% Long-Term Capital Gain Tax on the initial long-term gains over ₹1 Lakh. • Establish a new, higher-cost base (₹ 3,98,000) for future calculations, reducing your taxable gains down the line. And as your investments appreciate again by ₹ 1 lakh, you can repeat this process to further maximize your post-tax returns. For those investing through SIPs, remember to sell units purchased at least a year ago to qualify for tax-harvesting benefits. Disclaimer: This information is intended for educational purposes only and should not be considered a substitute for professional financial advice. [anushkarathod, tax, finance, taxharvesting] #finance #tax #LTCG #taxharvestingLikes : 112134

![Anushka Rathod - 100.6K Likes - Get married like Ambanis!

Ambani family spent “only” 0.5% of their net worth on Anant’s and Radhika’s wedding!

But do you know how much an average Indian spends on his/her wedding?

Check out the whole reel to know!!

This is Day 2 of 5 Smart Tips for Shaadi vale Ghar follow along as next reel will be on jewellery!!

On First App you can,

1. Make wedding checklist.

2. Find, compare and contact vendors

On Second app

1. It offers two plans: a free Basic plan and a paid gold plan.

2. With basic plan you can make detailed schedule of all the functions, and post real time updates.

On Third app,

1. Track your wedding budget.

2. Find, compare, and contact vendors

3. Create your free wedding website.

So, share this reel to those getting married.

[Anushka Rathod, wedding, finance, Ambanis, app, budget]

#anushkarathod #wedding #finance #ambanis #app #budget](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-14-EIMs1P3260.jpg)

100.6K Likes – Anushka Rathod Instagram

Caption : Get married like Ambanis! Ambani family spent “only” 0.5% of their net worth on Anant’s and Radhika’s wedding! But do you know how much an average Indian spends on his/her wedding? Check out the whole reel to know!! This is Day 2 of 5 Smart Tips for Shaadi vale Ghar follow along as next reel will be on jewellery!! On First App you can, 1. Make wedding checklist. 2. Find, compare and contact vendors On Second app 1. It offers two plans: a free Basic plan and a paid gold plan. 2. With basic plan you can make detailed schedule of all the functions, and post real time updates. On Third app, 1. Track your wedding budget. 2. Find, compare, and contact vendors 3. Create your free wedding website. So, share this reel to those getting married. [Anushka Rathod, wedding, finance, Ambanis, app, budget] #anushkarathod #wedding #finance #ambanis #app #budgetLikes : 100597

![Anushka Rathod - 96.4K Likes - Save taxes in your wedding!!!

Check out the whole reel to know!!

This is Day 1 of 10 Smart Tips for your mehnat ki kamai!!

Follow along, as next video is on how rich people invest for your kids!

Note:

GST on hotel accommodation( and it’s banquet hall) will depend on your room rent if its less than or equal to ₹7500 - it will be 12% and if its more than 7500, GST will be charged as 18%.

GST rate of 5% on composite supply with catering will be charged only when your room rent is less than or equal to 7,500.

If your room rent is higher than 7500, then it won’t matter whether you book separately or together - 18% will be charged.

Also, sometimes, it might be cheaper to hire separate vendors for venue and catering due to varying costs and services. So do your analysis.

[Anushka Rathod, finance, wedding, GST, Ambani]

#anushkarathod #finance #wedding #gst #ambani](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-11-4OLlHL9159.jpg)

96.4K Likes – Anushka Rathod Instagram

Caption : Save taxes in your wedding!!! Check out the whole reel to know!! This is Day 1 of 10 Smart Tips for your mehnat ki kamai!! Follow along, as next video is on how rich people invest for your kids! Note: GST on hotel accommodation( and it’s banquet hall) will depend on your room rent if its less than or equal to ₹7500 – it will be 12% and if its more than 7500, GST will be charged as 18%. GST rate of 5% on composite supply with catering will be charged only when your room rent is less than or equal to 7,500. If your room rent is higher than 7500, then it won’t matter whether you book separately or together – 18% will be charged. Also, sometimes, it might be cheaper to hire separate vendors for venue and catering due to varying costs and services. So do your analysis. [Anushka Rathod, finance, wedding, GST, Ambani] #anushkarathod #finance #wedding #gst #ambaniLikes : 96447

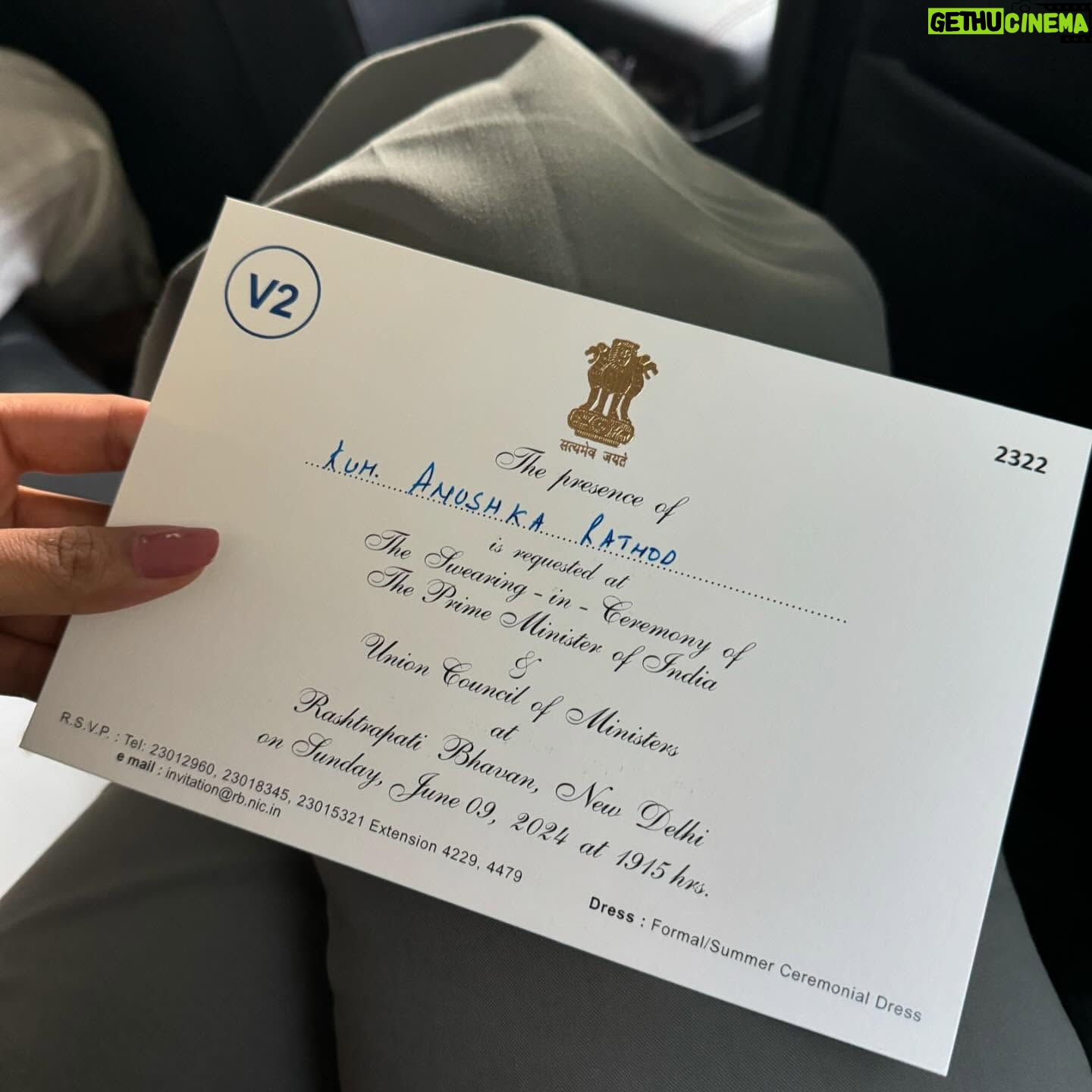

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

91.6K Likes – Anushka Rathod Instagram

Caption : Attended our Prime Minister’s swearing in ceremony at Rashtrapati bhavan today 😄 Beyond grateful to have received this invite!🫡Likes : 91645

![Anushka Rathod - 85.1K Likes - Couples don’t make this mistake!!

Check out the whole reel!

But the question is where do we invest??

Well, I’ve covered that in my book - The Money Guide!

Everything from:

1) Basic of mutual funds and the different types of mutual fund

2) Step by Step guidance on how to select mutual funds according to your financial goals.

3) How to make portfolio with different asset classes?

4) How to rebalance your portfolio?

5) Investments you should avoid and so on!

And with all this you’ll find editable tools, excel and worksheets etc.

So, get your copy today!

The link is in my BIO!

Disclaimer: We have assumed long term equity returns of 12% Actual values will vary depending upon the economic conditions, inflation, market etc.

[Anushka Rathod, finance, investments, couples, money guide]

#anushkarathod #finance #investments #couples #moneyguide](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-33-8ztOTo3477.jpg)

85.1K Likes – Anushka Rathod Instagram

Caption : Couples don’t make this mistake!! Check out the whole reel! But the question is where do we invest?? Well, I’ve covered that in my book – The Money Guide! Everything from: 1) Basic of mutual funds and the different types of mutual fund 2) Step by Step guidance on how to select mutual funds according to your financial goals. 3) How to make portfolio with different asset classes? 4) How to rebalance your portfolio? 5) Investments you should avoid and so on! And with all this you’ll find editable tools, excel and worksheets etc. So, get your copy today! The link is in my BIO! Disclaimer: We have assumed long term equity returns of 12% Actual values will vary depending upon the economic conditions, inflation, market etc. [Anushka Rathod, finance, investments, couples, money guide] #anushkarathod #finance #investments #couples #moneyguideLikes : 85126

![Anushka Rathod - 83.2K Likes - Continue in comments…

Who’s the richest person in your state?

Check out the whole reel to know!

Note: Net worth as of 28th Feb’ 24, and mentioned only major industries.

[Anushka Rathod, finance, businessman, Ambani, India]

#anushkarathod #finance #businessman #ambani #India](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-1-KurNFb4494.jpg)

83.2K Likes – Anushka Rathod Instagram

Caption : Continue in comments… Who’s the richest person in your state? Check out the whole reel to know! Note: Net worth as of 28th Feb’ 24, and mentioned only major industries. [Anushka Rathod, finance, businessman, Ambani, India] #anushkarathod #finance #businessman #ambani #IndiaLikes : 83241

![Anushka Rathod - 66.1K Likes - 1915 - National Helpline Number

1930 - Cyber Helpline Number

Banks don’t want you to know this!!

Imagine you get a message from your bank, “XXX amt debited from your bank account.”

Now You didn’t share any OTP or any confidential details.

Then How?

The truth is, even without sharing OTPs or confidential details, you are still vulnerable to a cyber fraud.

A similar case happened in Surat!

Check out the whole reel to know how she recovered her money!

According to RBI, when you notify the bank, remember to take acknowledgement from your bank. The bank has to resolve your complaint within 90 days from the date of receipt.

If the transaction has happened because of your negligence, that is, because of your sharing your password, PIN, OTP, etc., you will have to bear the loss till you report it to your bank. If the fraudulent transactions continue even after you have informed the bank, your bank will have to reimburse those amounts.

Source: Economic Times - Bank must refund money to customer for reported online fraud: Court

[anushka rathod, finance, fraud, bank, scams]

#anushkarathod #fraud #scamalert #cybersecurity](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-1-gaZ3WP3162.jpg)

66.1K Likes – Anushka Rathod Instagram

Caption : 1915 – National Helpline Number 1930 – Cyber Helpline Number Banks don’t want you to know this!! Imagine you get a message from your bank, “XXX amt debited from your bank account.” Now You didn’t share any OTP or any confidential details. Then How? The truth is, even without sharing OTPs or confidential details, you are still vulnerable to a cyber fraud. A similar case happened in Surat! Check out the whole reel to know how she recovered her money! According to RBI, when you notify the bank, remember to take acknowledgement from your bank. The bank has to resolve your complaint within 90 days from the date of receipt. If the transaction has happened because of your negligence, that is, because of your sharing your password, PIN, OTP, etc., you will have to bear the loss till you report it to your bank. If the fraudulent transactions continue even after you have informed the bank, your bank will have to reimburse those amounts. Source: Economic Times – Bank must refund money to customer for reported online fraud: Court [anushka rathod, finance, fraud, bank, scams] #anushkarathod #fraud #scamalert #cybersecurityLikes : 66069

65.4K Likes – Anushka Rathod Instagram

Caption : Unleash the lifestyle that you deserve, that’s #WorthyOfYou. Here’s a sneak peek of the newly launched HSBC Premier Credit Card, and I believe it’s not a card it’s a lifestyle upgrade! Forex markup: 0.99% Unlimited lounge access globally Joining fee: INR 12,000 Joining benefits: Taj Experiences gift card worth INR 12,000 Epicure membership across Taj Hotels And more. #HSBCCreditCards #HSBCIndia #ad #creditcard #mumbaiLikes : 65365

![Anushka Rathod - 57.7K Likes - 3 investment options for fixed monthly payments:

The first one is for senior citizens specifically and the other 2 can be done by anyone.

This is part 1 with fixed return instruments, part 2 with higher risk options will come soon.

1) Senior citizen saving scheme

This is the highest return option at the moment.

Eligibility - 60years

Returns - 8.2% p.a.

Maximum Investment - 30lakhs per person

Payout- Quarterly

Tenure - 5 years, can extend for 3 years multiple times post that

How to Invest - At a Post Office or bank branch

Taxes -Principal amount is tax exempt up to 1.5Lacs, Interest is taxed as per income slab

2) Post Office Monthly Income Scheme

Eligibility -Anyone

Returns - 7.4% p. a.

Maximum Investment - ₹9 Lakhs

Tenure - 5 years

How to Invest - At post office or If you already have an account then online also possible.

Taxes - Interest is taxed as per income slab

3) Tax Saver FD

Remember to opt for monthly payout option while booking the FD.

Eligibility - Anyone

Returns - 7.5% for senior citizens, 7% for everyone else

at IDFC, HDFC, ICICI Bank

Maximum Investment - No limit

Tenure - 5 years

How to Invest - Bank branch or online on bank website

Taxes - Principal amount is tax exempt up to 1.5Lacs, Interest is taxed as per income slab.

[anushka rathod, finance, investment, regular income, parents]

#anushkarathod #finance #investment #regularincome #parents](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-16-52YvIE5815.jpg)

57.7K Likes – Anushka Rathod Instagram

Caption : 3 investment options for fixed monthly payments: The first one is for senior citizens specifically and the other 2 can be done by anyone. This is part 1 with fixed return instruments, part 2 with higher risk options will come soon. 1) Senior citizen saving scheme This is the highest return option at the moment. Eligibility – 60years Returns – 8.2% p.a. Maximum Investment – 30lakhs per person Payout- Quarterly Tenure – 5 years, can extend for 3 years multiple times post that How to Invest – At a Post Office or bank branch Taxes -Principal amount is tax exempt up to 1.5Lacs, Interest is taxed as per income slab 2) Post Office Monthly Income Scheme Eligibility -Anyone Returns – 7.4% p. a. Maximum Investment – ₹9 Lakhs Tenure – 5 years How to Invest – At post office or If you already have an account then online also possible. Taxes – Interest is taxed as per income slab 3) Tax Saver FD Remember to opt for monthly payout option while booking the FD. Eligibility – Anyone Returns – 7.5% for senior citizens, 7% for everyone else at IDFC, HDFC, ICICI Bank Maximum Investment – No limit Tenure – 5 years How to Invest – Bank branch or online on bank website Taxes – Principal amount is tax exempt up to 1.5Lacs, Interest is taxed as per income slab. [anushka rathod, finance, investment, regular income, parents] #anushkarathod #finance #investment #regularincome #parentsLikes : 57737

![Anushka Rathod - 49.2K Likes - Do this to get your money back!

Imagine making a payment, only to realize moments later that you’ve entered the wrong number or UPI ID, thus sending the money to the wrong person.

Sounds like a nightmare, right?

But wait, here’s a way to get your money back!!

Check Out the whole reel!

For more details, continue reading-

After following the above processes, if the complaint remains unresolved, post 30 days you can approach the Banking Ombudsman and escalate the issue.

But as they say prevention is better than cure.

Before making any payment always double check all the details, like receiver name, number, upi id etc.

#anushkarathod #finance #upi #transaction #India #bank

[anushka Rathod, finance, upi, transaction, India, bank]](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-11-I6WaNI7220.jpg)

49.2K Likes – Anushka Rathod Instagram

Caption : Do this to get your money back! Imagine making a payment, only to realize moments later that you’ve entered the wrong number or UPI ID, thus sending the money to the wrong person. Sounds like a nightmare, right? But wait, here’s a way to get your money back!! Check Out the whole reel! For more details, continue reading- After following the above processes, if the complaint remains unresolved, post 30 days you can approach the Banking Ombudsman and escalate the issue. But as they say prevention is better than cure. Before making any payment always double check all the details, like receiver name, number, upi id etc. #anushkarathod #finance #upi #transaction #India #bank [anushka Rathod, finance, upi, transaction, India, bank]Likes : 49167

![Anushka Rathod - 44.9K Likes - This is how rich invests for their kids!

Check out the whole reel to know!!

This is Day 2 of 10 Smart tips for your Mehnat ki Kamai.

Follow along as next video is on how to invest for your parent’s retirement!!

Here are 4 things to keep in mind before doing this-

1. Math for 12 Lakhs Tax free - Capital gains exemption - [100,000 x 3 = 300,000] Basic Exemption (New tax regime) [300,000 x 3 = 900,0000]. Do Note tax laws can change so your actual savings might differ, but basic exemption is expected to increase only.

2. After your child turns 18, they will have the control of the investment. So, they can withdraw the money without your permission!

3. If for some reason you redeem the mutual fund before they turn 18, then the capital gains will be clubbed to your income.

4. When the child turns 18, the parent can no longer operate the SIP. The account holder must then manage it themselves. Before this, the AMC will ask for an application, documents, and a KYC letter to change the folio status from ‘minor’ to ‘major’.

Note: We have assumed long term equity returns of 14% actual returns will vary depending upon the economic conditions, market etc.

[Anushka Rathod, finance, investment, kids, education, neet]

#anushkarathod #finance #investment #kids #education #neet](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-10-vn3FrH2825.jpg)

44.9K Likes – Anushka Rathod Instagram

Caption : This is how rich invests for their kids! Check out the whole reel to know!! This is Day 2 of 10 Smart tips for your Mehnat ki Kamai. Follow along as next video is on how to invest for your parent’s retirement!! Here are 4 things to keep in mind before doing this- 1. Math for 12 Lakhs Tax free – Capital gains exemption – [100,000 x 3 = 300,000] Basic Exemption (New tax regime) [300,000 x 3 = 900,0000]. Do Note tax laws can change so your actual savings might differ, but basic exemption is expected to increase only. 2. After your child turns 18, they will have the control of the investment. So, they can withdraw the money without your permission! 3. If for some reason you redeem the mutual fund before they turn 18, then the capital gains will be clubbed to your income. 4. When the child turns 18, the parent can no longer operate the SIP. The account holder must then manage it themselves. Before this, the AMC will ask for an application, documents, and a KYC letter to change the folio status from ‘minor’ to ‘major’. Note: We have assumed long term equity returns of 14% actual returns will vary depending upon the economic conditions, market etc. [Anushka Rathod, finance, investment, kids, education, neet] #anushkarathod #finance #investment #kids #education #neetLikes : 44933

![Anushka Rathod - 44.8K Likes - Tag you Gujju & Marwardi Friends!!

[Anushka rathod, keepitsimplewithtwinkle, finance, surat, gujurat business, lifestyle]

#anushkarathod #keepitsimplewithtwinkle #finance #surat #gujarat #business #lifestyle](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-1-FVcLYN3846.jpg)

44.8K Likes – Anushka Rathod Instagram

Caption : Tag you Gujju & Marwardi Friends!! [Anushka rathod, keepitsimplewithtwinkle, finance, surat, gujurat business, lifestyle] #anushkarathod #keepitsimplewithtwinkle #finance #surat #gujarat #business #lifestyleLikes : 44817

![Anushka Rathod - 42.8K Likes - Looking for refund? Check that website first!

But why? Keep watching to find out!

Spoiler: Always visit the company’s official website for customer support.

Remember, @upichalega is secure, but online safety starts with you!

So, share with friends and family!!

[ad, Anushka Rathod, finance, UPI, safety awareness, GOI]

#ad #anushkarathod #finance #UPI #GyaanSeDhyaanSe #GOI #safetyawareness](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-11-dODv3n2516.jpg)

42.8K Likes – Anushka Rathod Instagram

Caption : Looking for refund? Check that website first! But why? Keep watching to find out! Spoiler: Always visit the company’s official website for customer support. Remember, @upichalega is secure, but online safety starts with you! So, share with friends and family!! [ad, Anushka Rathod, finance, UPI, safety awareness, GOI] #ad #anushkarathod #finance #UPI #GyaanSeDhyaanSe #GOI #safetyawarenessLikes : 42779

42.8K Likes – Anushka Rathod Instagram

Caption : DIwali Vibes with Surat Creators❤️ @cyber_detectives @ca.twinklejain @ankitdrobow @thebrowndaughter @anushkarathod98Likes : 42757

![Anushka Rathod - 38.7K Likes - Due to high comment traffic, Instagram has restricted commenting on this post. But if you'd still like to access the retirement calculator, you can easily find it on Google by searching: Wealthcare Retirement Calculator

Being a crorepati is not enough!!

For your retirement!

Check out the whole reel to know how much need for retirement to maintain your current lifestyle.

Comment “Mehnat ki kamai” and I’ll DM you the link.

This is Day 6 of 10 smart tips for your Mehnat ki kamai

Follow along as next reel will be on how rich people save taxes!

[Anushka Rathod, finance, retirement, crorepati, investment]

#anushkarathod #finance #retirement #crorepati #investment](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-25-EzLUwH4354.jpg)

38.7K Likes – Anushka Rathod Instagram

Caption : Due to high comment traffic, Instagram has restricted commenting on this post. But if you’d still like to access the retirement calculator, you can easily find it on Google by searching: Wealthcare Retirement Calculator Being a crorepati is not enough!! For your retirement! Check out the whole reel to know how much need for retirement to maintain your current lifestyle. Comment “Mehnat ki kamai” and I’ll DM you the link. This is Day 6 of 10 smart tips for your Mehnat ki kamai Follow along as next reel will be on how rich people save taxes! [Anushka Rathod, finance, retirement, crorepati, investment] #anushkarathod #finance #retirement #crorepati #investmentLikes : 38718

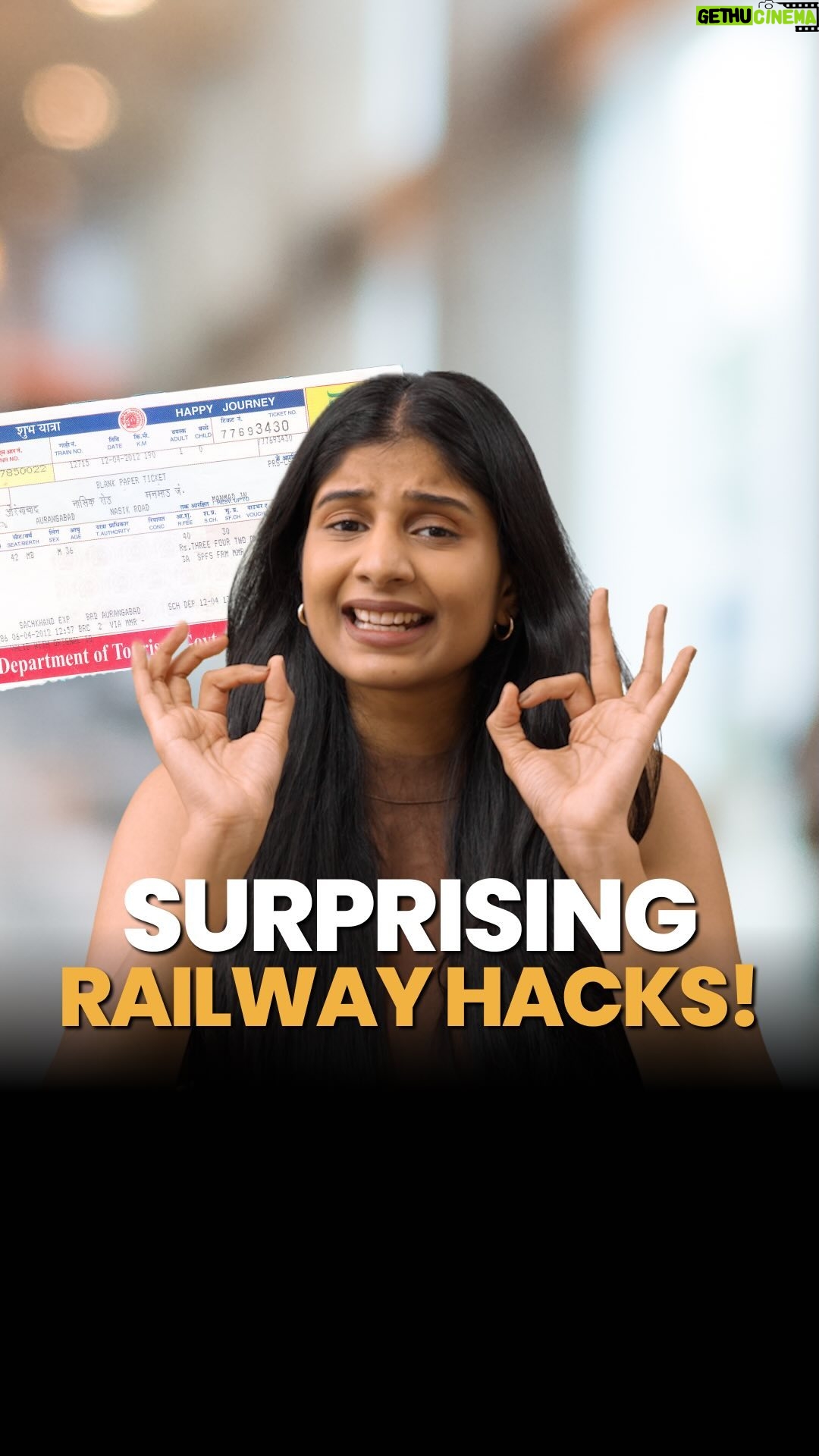

37.5K Likes – Anushka Rathod Instagram

Caption : Struggling to get a confirmed train ticket this festive season? Then check out the reel for hacks to get a confirmed ticket! But remember, these hacks come with conditions: 1. Using Charts to locate vacancy Keep in mind that the waiting ticket should be obtained from the ticket window. Online unconfirmed tickets are not eligible for this! If you book online and your ticket isn’t confirmed by the chart preparation time, you can’t board the train. You’ll get a refund instead. And Train Ticket Examiners (TTE) can refuse to give a ticket. If that happens, you’ll need to get off at the next stop. 2. Confirmedtkt App Do note Confirmtkt app charges convenience fees. So, you can use Confirrmtkt to check the availability & book tickets from IRCTC only. Source: Economic Times Article: Traveling by train? Here is how you can travel without a confirmed ticket.Likes : 37451

![Anushka Rathod - 36.6K Likes - Imagine taking a selfie with your new iPhone, and out of nowhere, someone swoops in and snatches it away.

To secure yourself from such a situation do what I mentioned in the reel!

This new feature adds a layer of security when your Phone is outside familiar spots like home or work, shielding your accounts and info if it’s stolen.

Here’s How you can turn this on-

1. Enable two-factor authentication for your Apple ID.

2. On your iPhone, set up or activate: a device passcode, Face ID or Touch ID, Find My, and Significant Locations (Location Services).

3. To activate Stolen Device Protection:

a. Navigate to Settings.

b. Tap Face ID & Passcode.

c. Enter your device passcode.

d. Toggle Stolen Device Protection on.

Note: Turning off Stolen Device Protection outside familiar locations incurs a security delay.

Remember to disable Stolen Device Protection before selling, giving away, or trading in your iPhone.

[Anushka Rathod, finance, iPhone, India, news, apple]

#anushkarathod #finance #iPhone #India #news #apple](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-10-8iyS081531.jpg)

36.6K Likes – Anushka Rathod Instagram

Caption : Imagine taking a selfie with your new iPhone, and out of nowhere, someone swoops in and snatches it away. To secure yourself from such a situation do what I mentioned in the reel! This new feature adds a layer of security when your Phone is outside familiar spots like home or work, shielding your accounts and info if it’s stolen. Here’s How you can turn this on- 1. Enable two-factor authentication for your Apple ID. 2. On your iPhone, set up or activate: a device passcode, Face ID or Touch ID, Find My, and Significant Locations (Location Services). 3. To activate Stolen Device Protection: a. Navigate to Settings. b. Tap Face ID & Passcode. c. Enter your device passcode. d. Toggle Stolen Device Protection on. Note: Turning off Stolen Device Protection outside familiar locations incurs a security delay. Remember to disable Stolen Device Protection before selling, giving away, or trading in your iPhone. [Anushka Rathod, finance, iPhone, India, news, apple] #anushkarathod #finance #iPhone #India #news #appleLikes : 36647

![Anushka Rathod - 36.4K Likes - 12% of Mutual Fund Accounts ON HOLD!

Are you one of them?

Check out the whole reel to know what is happening!

Here’s what different status mean-

1.Registered/Verified: It means your documents cannot be directly verified by the issuing authority and do not include PAN or Aadhaar. Although existing investments remain unaffected, new investments require resubmission of KYC documents.

2.On Hold: Documents not valid or contact details not verified. Transactions restricted until contact details verified or valid documents submitted.

If KYC status is Registered/Verified/On hold, follow these steps:

1.Log into your account with the respective fund house you invest with.

2.You will be able to view your status under your profile. Here, you will get the option to update it.

3.You can use m-Aadhaar or e-Aadhar for this.

4.Once your Aadhar Card is verified with UIDAI, your KYC will be validated across all the fund houses.

If you have any doubts, then let me know in the comments.

[Anushka Rathod, finance, investment, mutual funds, KYC]

#anushkarathod #finance #investment #mutualfunds #kyc](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-4-LF2mGy9116.jpg)

36.4K Likes – Anushka Rathod Instagram

Caption : 12% of Mutual Fund Accounts ON HOLD! Are you one of them? Check out the whole reel to know what is happening! Here’s what different status mean- 1.Registered/Verified: It means your documents cannot be directly verified by the issuing authority and do not include PAN or Aadhaar. Although existing investments remain unaffected, new investments require resubmission of KYC documents. 2.On Hold: Documents not valid or contact details not verified. Transactions restricted until contact details verified or valid documents submitted. If KYC status is Registered/Verified/On hold, follow these steps: 1.Log into your account with the respective fund house you invest with. 2.You will be able to view your status under your profile. Here, you will get the option to update it. 3.You can use m-Aadhaar or e-Aadhar for this. 4.Once your Aadhar Card is verified with UIDAI, your KYC will be validated across all the fund houses. If you have any doubts, then let me know in the comments. [Anushka Rathod, finance, investment, mutual funds, KYC] #anushkarathod #finance #investment #mutualfunds #kycLikes : 36401

![Anushka Rathod - 35.9K Likes - Don’t delay for this,

else your child will lose 66 lakhs.

Check out the whole reel to know!

Note: We have assumed long term equity returns of 12%, this may vary depending on the market and economic situation. So before making any investments consult a financial advisor.

[Anushka Rathod, finance, Investment, child, education]

#anushkarathod #finance #investment #child #education](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-0-UfD4XF9671.jpg)

35.9K Likes – Anushka Rathod Instagram

Caption : Don’t delay for this, else your child will lose 66 lakhs. Check out the whole reel to know! Note: We have assumed long term equity returns of 12%, this may vary depending on the market and economic situation. So before making any investments consult a financial advisor. [Anushka Rathod, finance, Investment, child, education] #anushkarathod #finance #investment #child #educationLikes : 35873

![Anushka Rathod - 35.3K Likes - Save ₹₹₹ on your grocery bill!!

Do you also feel that 10-minute delivery drains your hard earned savings ?

If yes, then here is something that might help you!!

Check out the whole reel!

With @flipkartgrocery_ , you can save up to 25% to 30% off on your grocery purchases!

Just place your order, and it will be delivered to your doorstep in 24 hours!

Just go to Flipkart, and select Flipkart Grocery tab.

So, don’t wait, order your groceries now from Flipkart grocery.

[ad, Anushka Rathod, finance, lifestyle, Flipkart grocery]

#ad #anushkarathod #finance #lifestyle #flipkartgrocery](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-7-4qVWAC2086.jpg)

35.3K Likes – Anushka Rathod Instagram

Caption : Save ₹₹₹ on your grocery bill!! Do you also feel that 10-minute delivery drains your hard earned savings ? If yes, then here is something that might help you!! Check out the whole reel! With @flipkartgrocery_ , you can save up to 25% to 30% off on your grocery purchases! Just place your order, and it will be delivered to your doorstep in 24 hours! Just go to Flipkart, and select Flipkart Grocery tab. So, don’t wait, order your groceries now from Flipkart grocery. [ad, Anushka Rathod, finance, lifestyle, Flipkart grocery] #ad #anushkarathod #finance #lifestyle #flipkartgroceryLikes : 35300

![Anushka Rathod - 33.8K Likes - When Crime Meets Creativity

Do you use ATM?

If yes, then watch the whole reel so that you don’t get scammed.

This is just the tip of the iceberg when it comes to ATM scams, there are many other ways scammers can cheat at an ATM.

So, to make sure that you don’t fall for it-

1) Always check that there is no extra device attached, near the card insertion slot or keypad of the ATM machine, before making a transaction.

2)Do NOT enter the PIN in the presence of any other / unknown person standing close to you. Cover the keypad with your other hand while entering the PIN.

[anushka rathod, scams, atm, banks, cyber fraud]

#anushkarathod #scams #atm #bank #fraudalert](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-12-LwaSZG8674.jpg)

33.8K Likes – Anushka Rathod Instagram

Caption : When Crime Meets Creativity Do you use ATM? If yes, then watch the whole reel so that you don’t get scammed. This is just the tip of the iceberg when it comes to ATM scams, there are many other ways scammers can cheat at an ATM. So, to make sure that you don’t fall for it- 1) Always check that there is no extra device attached, near the card insertion slot or keypad of the ATM machine, before making a transaction. 2)Do NOT enter the PIN in the presence of any other / unknown person standing close to you. Cover the keypad with your other hand while entering the PIN. [anushka rathod, scams, atm, banks, cyber fraud] #anushkarathod #scams #atm #bank #fraudalertLikes : 33752

![Anushka Rathod - 33.4K Likes - Get free flight tickets for your Honeymoon!

Check out the whole reel to know how!

This is day 5 of smart tips for Shaadi vale Ghar!!

For more details, keep reading-

1.SBI Air India Signature

a.Annual Fees - ₹ 4,999 taxes.

b.Welcome Benefit - 20,000 Reward Points

c.Earn - 4 RP per ₹100 spent on normal spends, 30 RP per ₹ 100 spent on Air India tickets.

d.Redeem - 1 RP = 1 Air India Mile.

e.Air Mile redemption will be possible for minimum 10,000 reward points and in multiples of 5,000. Reward Points once converted into Air India Air Miles cannot be reversed

2.Axis Atlas

a.Annual Fees - ₹ 5000 fees

b.Welcome benefit - 2500 Edge Miles

c.Earn - 5 Edge Miles per ₹ 100 spent on travel related spends (Airlines and Hotel maximum spends up to ₹ 2 lakhs) and 2 Edge Miles per ₹ 100 spent on normal spends.

d.Redeem - 1 Edge Mile = ₹ 1, or 1 Edge Mile = 2 partner miles (airlines and hotels)

3.HDFC Infinia - Invite only credit card.

a.Annual Fees - ₹12,500 Taxes

b.Welcome benefit - 12,500 Reward Points

c.Earn - 5 RP per ₹ 150 spent on retail spends (including insurance, jewellery) and up to 10 times RP on your travel and shopping spends on smart buy.

d.Redeem

i.Flight and hotel on smart buy 1 RP = ₹ 1

ii.Cashback - 1RP - ₹ 0.3

iii.Apple products and Tanishq vouchers via Smart buy - 1RP = ₹ 1

e.Note: Redeem up to maximum of 70% on the travel bookings (Flights, Hotel and experiences) using reward points. The balance amount will need to be paid via credit card

With this you also get other discount offers, lounge access - domestic and international and other benefits.

Note: Terms and conditions apply for every card, lounge access, spending limit, eligible transaction, criteria, reward redemption etc. so decide accordingly.

[Anushka Rathod, finance, wedding, Ambani, credit cards, travel]

#anushkarathod #finance #wedding #ambani #creditcards #trave](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-37-ZfAXBo36.jpg)

33.4K Likes – Anushka Rathod Instagram

Caption : Get free flight tickets for your Honeymoon! Check out the whole reel to know how! This is day 5 of smart tips for Shaadi vale Ghar!! For more details, keep reading- 1.SBI Air India Signature a.Annual Fees – ₹ 4,999 taxes. b.Welcome Benefit – 20,000 Reward Points c.Earn – 4 RP per ₹100 spent on normal spends, 30 RP per ₹ 100 spent on Air India tickets. d.Redeem – 1 RP = 1 Air India Mile. e.Air Mile redemption will be possible for minimum 10,000 reward points and in multiples of 5,000. Reward Points once converted into Air India Air Miles cannot be reversed 2.Axis Atlas a.Annual Fees – ₹ 5000 fees b.Welcome benefit – 2500 Edge Miles c.Earn – 5 Edge Miles per ₹ 100 spent on travel related spends (Airlines and Hotel maximum spends up to ₹ 2 lakhs) and 2 Edge Miles per ₹ 100 spent on normal spends. d.Redeem – 1 Edge Mile = ₹ 1, or 1 Edge Mile = 2 partner miles (airlines and hotels) 3.HDFC Infinia – Invite only credit card. a.Annual Fees – ₹12,500 Taxes b.Welcome benefit – 12,500 Reward Points c.Earn – 5 RP per ₹ 150 spent on retail spends (including insurance, jewellery) and up to 10 times RP on your travel and shopping spends on smart buy. d.Redeem i.Flight and hotel on smart buy 1 RP = ₹ 1 ii.Cashback – 1RP – ₹ 0.3 iii.Apple products and Tanishq vouchers via Smart buy – 1RP = ₹ 1 e.Note: Redeem up to maximum of 70% on the travel bookings (Flights, Hotel and experiences) using reward points. The balance amount will need to be paid via credit card With this you also get other discount offers, lounge access – domestic and international and other benefits. Note: Terms and conditions apply for every card, lounge access, spending limit, eligible transaction, criteria, reward redemption etc. so decide accordingly. [Anushka Rathod, finance, wedding, Ambani, credit cards, travel] #anushkarathod #finance #wedding #ambani #creditcards #traveLikes : 33397

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

33.2K Likes – Anushka Rathod Instagram

Caption : Happy Rakshabandhan ✨✨Likes : 33229

![Anushka Rathod - 33K Likes - This Govt Backed scheme will double your investments!!

How?

Check out the whole reel.

Do note, this video is only for educational purpose and not an investment recommendation.

But how to invest?

To invest in the instrument visit a nearby post office or bank to get Form-A or Form A1 for agent-assisted investments. Complete the form, submit it with KYC, ID, and address proof, along with the funds. Receive the

KVP certificate promptly, safeguarding it for maturity submission.

Get the KVP certificate and keep it safe till maturity.

Here are the additional details.

→ There are no tax benefits, returns are completely taxable.

→ Deposit a minimum of Rs. 1,000 in this scheme, with no maximum limit

→ Premature redemption - After 2.5 years, the amount shall be payable as specified by the post office. Note it’s less than the total compounded amount for that period.

→The investment is compounded yearly.

Disclaimer: This video should not be a replacement for professional investment advice.

[anushka rathod, finance, investment, post office, kvp]

#anushkarathod #finance #invetsment #postofficeschemes #kvp](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-10-Jv8fWi3456.jpg)

33K Likes – Anushka Rathod Instagram

Caption : This Govt Backed scheme will double your investments!! How? Check out the whole reel. Do note, this video is only for educational purpose and not an investment recommendation. But how to invest? To invest in the instrument visit a nearby post office or bank to get Form-A or Form A1 for agent-assisted investments. Complete the form, submit it with KYC, ID, and address proof, along with the funds. Receive the KVP certificate promptly, safeguarding it for maturity submission. Get the KVP certificate and keep it safe till maturity. Here are the additional details. → There are no tax benefits, returns are completely taxable. → Deposit a minimum of Rs. 1,000 in this scheme, with no maximum limit → Premature redemption – After 2.5 years, the amount shall be payable as specified by the post office. Note it’s less than the total compounded amount for that period. →The investment is compounded yearly. Disclaimer: This video should not be a replacement for professional investment advice. [anushka rathod, finance, investment, post office, kvp] #anushkarathod #finance #invetsment #postofficeschemes #kvpLikes : 33015

![Anushka Rathod - 32.7K Likes - Don’t make wrong choices!!

Check out the whole reel!

This is Day 5 of 10 Smart Tips for your Mehnat ki Kamai,

Follow along as next reel will be on how much money do you need to retire!

Here’s why you should avoid them-

1.Endowment plans & ULIPS -

a. These plans combine Investment and insurance. While suitable in some cases, they usually offer inadequate insurance, lower returns and come in long lock in periods.

b. Plus, these plans have various charges, like premium allocation, policy administration, fund management, mortality, and surrender charges, which reduce your returns

2.Digital gold -

a. There is no regulatory authority for digital gold platforms to secure the interest of consumers plus, they also have charges like storage fees and 3% GST which reduce the returns.

b. Also, when buying gold, buyers often pay a higher price than what sellers get. This price difference is called the ‘bid-ask spread,’ usually 2-3% for digital gold.

3.Child Insurance plans -

a.They operate similar to either ULIPs or Endowment Plan.

b.The difference is, in child plans if the parent dies, future premiums are waived, and the insurer keeps investing. The maturity benefits are paid as planned.

c.However, both types often provide low coverage and returns, making them less effective as insurance or investment. So, it’s better to take a separate term insurance for yourself and invest for your child education separately.

4.Risky Stocks and trading

a.Unless and until you are a trader or you have professional guidance, it is better to stick to long-term investing in equity mutual funds and good quality stocks.

Disclaimer: This video is for education purpose only and should not be a replacement for professional investment advice.

[Anushka Rathod, finance, investment, mistakes, mutual funds]

#anushkarathod #finance #investment #mistakes #mutualfunds](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-26-3tsqDS2778.jpg)

32.7K Likes – Anushka Rathod Instagram

Caption : Don’t make wrong choices!! Check out the whole reel! This is Day 5 of 10 Smart Tips for your Mehnat ki Kamai, Follow along as next reel will be on how much money do you need to retire! Here’s why you should avoid them- 1.Endowment plans & ULIPS – a. These plans combine Investment and insurance. While suitable in some cases, they usually offer inadequate insurance, lower returns and come in long lock in periods. b. Plus, these plans have various charges, like premium allocation, policy administration, fund management, mortality, and surrender charges, which reduce your returns 2.Digital gold – a. There is no regulatory authority for digital gold platforms to secure the interest of consumers plus, they also have charges like storage fees and 3% GST which reduce the returns. b. Also, when buying gold, buyers often pay a higher price than what sellers get. This price difference is called the ‘bid-ask spread,’ usually 2-3% for digital gold. 3.Child Insurance plans – a.They operate similar to either ULIPs or Endowment Plan. b.The difference is, in child plans if the parent dies, future premiums are waived, and the insurer keeps investing. The maturity benefits are paid as planned. c.However, both types often provide low coverage and returns, making them less effective as insurance or investment. So, it’s better to take a separate term insurance for yourself and invest for your child education separately. 4.Risky Stocks and trading a.Unless and until you are a trader or you have professional guidance, it is better to stick to long-term investing in equity mutual funds and good quality stocks. Disclaimer: This video is for education purpose only and should not be a replacement for professional investment advice. [Anushka Rathod, finance, investment, mistakes, mutual funds] #anushkarathod #finance #investment #mistakes #mutualfundsLikes : 32677

![Anushka Rathod - 31.8K Likes - First the government and now RBI has given good news!

The RBI MPC has cut the Repo Rate for the first time in 5 years from 6.5% to 6.25% in a bid to stimulate economic activity.

This came in the backdrop of a slowing economy, which is estimated to grow at 6.4% in FY2024-25, the slowest in four years.

The RBI estimates GDP growth in next fiscal year at about 6.7%.

The CPI inflation for 2025-26 is projected at 4.2% which is under the RBI’s tolerance band.

What does this mean for you? Lower EMIs, cheaper loans, but also a drop in FD rates

[Anushka Rathod, Reserve Bank, Interest Rates, Fixed deposits, Low EMI]

#anushkarathod #reservebank #interestrates #Fixed Deposits #lowemi](https://www.gethucinema.com/wp-content/uploads/2025/02/Anushka-Rathod-22-IdF35b3822.jpg)

31.8K Likes – Anushka Rathod Instagram

Caption : First the government and now RBI has given good news! The RBI MPC has cut the Repo Rate for the first time in 5 years from 6.5% to 6.25% in a bid to stimulate economic activity. This came in the backdrop of a slowing economy, which is estimated to grow at 6.4% in FY2024-25, the slowest in four years. The RBI estimates GDP growth in next fiscal year at about 6.7%. The CPI inflation for 2025-26 is projected at 4.2% which is under the RBI’s tolerance band. What does this mean for you? Lower EMIs, cheaper loans, but also a drop in FD rates [Anushka Rathod, Reserve Bank, Interest Rates, Fixed deposits, Low EMI] #anushkarathod #reservebank #interestrates #Fixed Deposits #lowemiLikes : 31750

![Anushka Rathod - 31.1K Likes - Want to grow your business? TAKE IT ONLINE!

But what about the cost and complexity?

Then here’s a software that might help you.

Check out the whole reel!

@odoo.official is an ERP software that covers all your company needs from accounting, inventory to website building and more – it’s got your back.

Create your first website effortlessly – no coding needed!

Odoo will let you customize your website and have a great online presence to perfectly suit your industry.

What about cost?

First app is free forever with unlimited support and hosting. Get a custom domain free for a year!

So, if you also you want to digitize your business then check the link in Bio.

[anushka rathod, finance, business, software]

#ad #anushkarathod #finance #business #software](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-23-h0RFjd8355.jpg)

31.1K Likes – Anushka Rathod Instagram

Caption : Want to grow your business? TAKE IT ONLINE! But what about the cost and complexity? Then here’s a software that might help you. Check out the whole reel! @odoo.official is an ERP software that covers all your company needs from accounting, inventory to website building and more – it’s got your back. Create your first website effortlessly – no coding needed! Odoo will let you customize your website and have a great online presence to perfectly suit your industry. What about cost? First app is free forever with unlimited support and hosting. Get a custom domain free for a year! So, if you also you want to digitize your business then check the link in Bio. [anushka rathod, finance, business, software] #ad #anushkarathod #finance #business #softwareLikes : 31138

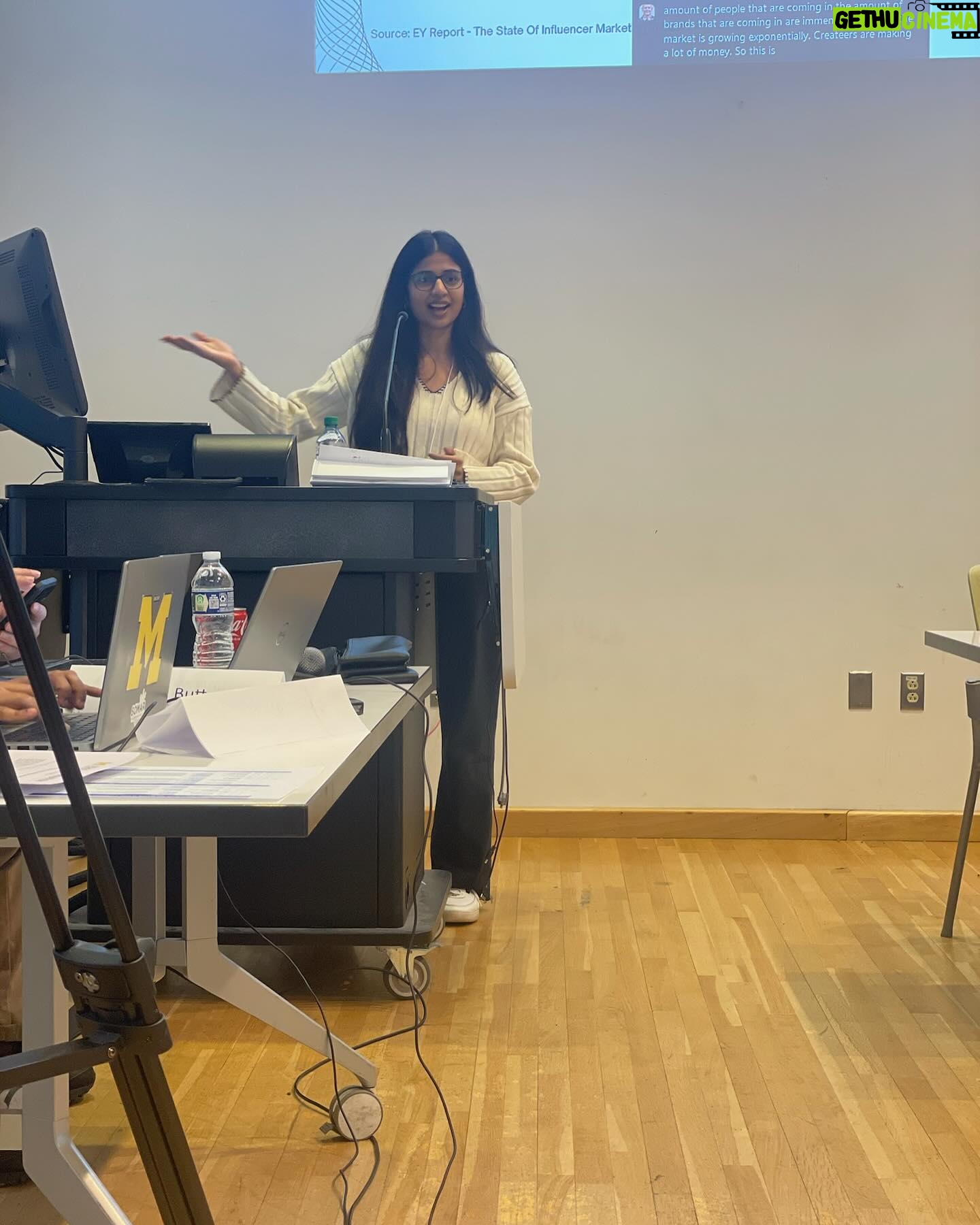

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

31.1K Likes – Anushka Rathod Instagram

Caption : If 4 years ago you would have told me that a LEADING US UNIVERSITY would invite me to give a talk, all expenses paid, I would have laughed at your face! BUT IT ACTUALLY HAPPENED! I got invited to University of Michigan to talk about the finance content creation space in India. 4 years back I was all set to go to the US for my masters, worked really hard and got into my dream uni as well with a scholarship but had to drop it because of COVID. Instead I started making videos from my room in the lockdown and it has given me more than I could ever imagine! Now, I am teaching others on how to start their content creation journey, join me this Saturday for same the link to the masterclass is in my BIO! (subtle plug haha) But April has been full of pinch me moments for me! I travelled solo in the US, met old friends and made some new! Tried soo many different cuisines – Egyptian, Peruvian, Salvadorian, Jamaican, Thai, Chinese, Lebanese, Japanese, Korean, Vietnamese, Italian and Mexican! Saw a lot of sunsets, went on a lot of drives and came back with a full heart and memories that I will cherish for life!Likes : 31097

![Anushka Rathod - 30.6K Likes - I wish I knew this before!!

I would have saved time and money!

This is Day 10 of 10 smart tips for your Mehnat ki Kamai!!

Platforms like Myntra, Amazon also offer AI image recognition, where you can upload a picture and find similar items.

However, you still need to visit each app to compare prices.

But with this app, you can see prices from all websites in one place.

So, you can use this when buying expensive items like sneakers.

Infact if you’re traveling abroad and not sure whether a brand is cheaper in India or in that country, you can easily check prices using this app.

Also, for all the love that you have shown on this series!

I’ve decided to give a special discount on my actionable and interactive book on finance - The Money Guide!

Just use coupon “MEHNAT”, The Link is in my BIO!!

Note: Always verify the credentials and authenticity of any website before making a purchase.

[Anushka Rathod, finance, shopping, google, lifestyle, money guide]

#anushkarathod #finance #shopping #google #lifestyle #moneyguide](https://www.gethucinema.com/wp-content/uploads/2025/01/Anushka-Rathod-26-UzACIB7322.jpg)

30.6K Likes – Anushka Rathod Instagram